Operators Save Money With Online Water Management

Published on by Marina A, Previously Key Account and Content Manager at AquaSPE AG in Business

There are few good options for water sourcing and disposal for upstream energy producers in Pennsylvania. The practical solution that has evolved in the region is operator-to-operator trades of produced fluid and freshwater.

Most operators have participated in at least one or two inter-operator trades. However, the lack of efficient organizational and communication tools has constrained the practice.

“Recycling production fluids between operators reduces both freshwater withdrawals and injection into disposal sites,” said Matthew Alaniz, water team lead for Shell Appalachia. “Sourcewater connects us within the oil and gas community, making it easier for us to engage in operator-to-operator trades.”

In the Marcellus region local communities are highly sensitive to the impacts of truck traffic, and the region has few local options for underground injection-controlled disposal. In response, service providers offer third-party water management.

They gather production water and treat it to clean brine standards, which they try to mark up and sell back to operators for new fracturing operations, acting in effect as water brokers and distributors. The slowdown in completions has devastated this business, often forcing these facilities to truck brine long distances at a loss or shut down entirely.

Recent market conditions pushed operators to break from that status quo, looking for new ways to reduce cost and increase operational efficiency. Marcellus operators are engaging more frequently in direct operator-to-operator trades.

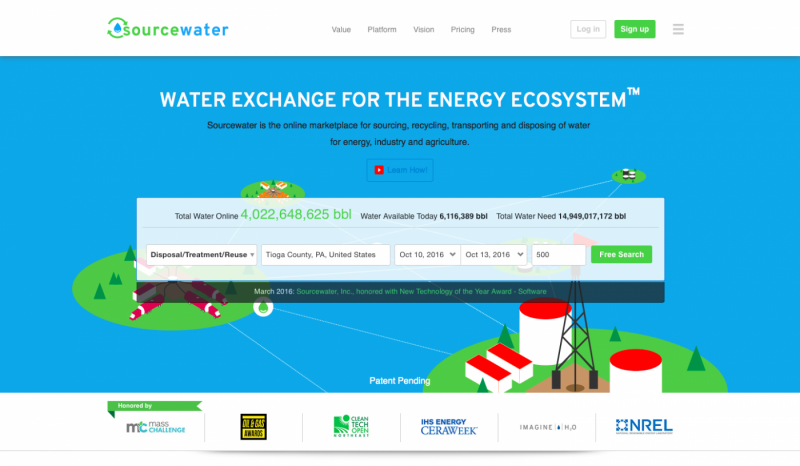

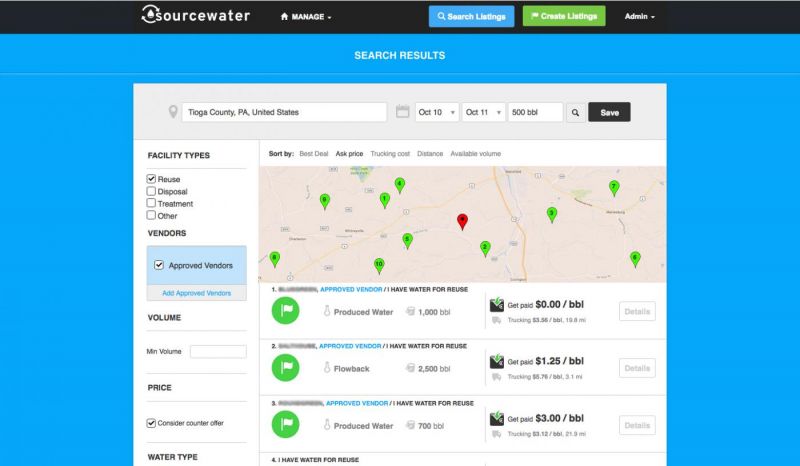

These trades enable the produced fluid or excess freshwater from one producer to be used in the completion of another. By organizing themselves into sub-regional water-sharing groups on Sourcewater, a free online marketplace for water sourcing, recycling, hauling and disposal, operators can identify and execute these opportunities directly, resulting in:

- Increased efficiency in water management;

- Improved community relations from fewer truck miles on the roads; and

- Better margins through reduced operating and completion costs.

Increased water management efficiency

Effective oilfield water management is as much about relationship management as it is about water chemistry and infrastructure investment. Water management professionals at both operating companies and service providers often rely on personal contacts and word of mouth in county-level micromarkets to obtain best pricing and opportunities for sourcing, recycling and disposing of fluids.

To coordinate a project’s water management needs, a typical operator in the Marcellus will spend at least 4 hours on the phone reaching out to four to eight other operators to find deals.

These calls often result in missed connections, nonproductive workday conversations, missed opportunities and trades that are mispriced because of relationship concerns rather than economics.

Coordinating the same transactions through Sourcewater takes on average 10 minutes to 20 minutes and ensures real-time visibility into all available options, eliminating errors and missed opportunities and ensuring that transparent economics drive management decisions.

Operator-to-operator trading reduces truck traffic

“Shell is committed to being a good steward of both the environment and the community in which we work,” Alaniz said. “Sourcewater helps me minimize trucking in the region, which lowers the risk of spills and reduces road damage and congestion impact on the local communities.”

Strategies for water management in the Marcellus have evolved since the early days of the play. These strategies are all linked to the impacts of water hauling in the region. First there were disposers and then empire builders, and now a new paradigm is developing: community enablers.

Disposers made their operational decisions purely on economics. This strategy opted to haul fluids out of state or pay service providers to treat waste locally. Their strategy caused local tension with high levels of truck traffic.

As the play matured and completions activity peaked, the industry saw the rise of “empire builders.” Operators adopting this strategy recognized the opportunity to better manage community relations, environmental risk and increased efficiency by keeping water management within their own operations.

Empire builders invested capital in pipeline, storage and treatment capacity. They were the first to recognize the opportunity to reduce truck traffic through fluid recycling within their operations.

Today residents of Pennsylvania are acutely concerned with road damage, traffic congestion and accident risk related to water hauling. “Community enablers” have responded with a new water management strategy.

Motivated to reduce truck miles, these operators engage in direct operator-to-operator transactions. Community enablers create sub-regional markets for sharing water resources and infrastructure that eliminate long-distance fluid hauling and also avoid the duplication of hauling fluid first to an intermediate storage facility and then to a well site for completions.

These operators use a spot market for fluids to reduce truck traffic, cost and waste.

Operator-to-operator water trading saves real money

Operators engage in local water sharing groups on Sourcewater to obtain cost savings. The labor cost to find and secure water trades is reduced by more than 90% online, with better odds of finding (or not missing) the best opportunities and ensuring that trades are priced correctly on transparent market economics.

Hauling costs are substantially reduced when fluids are not transported long distances or only one truck trip is required directly between source and use rather than multiple trips to and from an intermediate facility. Disposal and sourcing costs are reduced when operators trade fluids directly.

Typically, the disposing operator pays delivery cost to the completions site, which is much closer and therefore less costly than the next best disposal alternative. Sometimes the disposer offers an additional payment above cost to entice other operators to reuse fluids rather than pay for fresh water. Both end up saving and, in some cases, completions can become a profit center.

Source: E&P

Media

Taxonomy

- Technology

- Water Management

- Water Management

- Online Content